From our mission to our markets, Southern Bancorp is a unique financial institution that was founded to help strengthen underserved communities through financial access and investment. By combining traditional banking and lending services with financial development tools ranging from credit counseling to public policy advocacy, Southern Bancorp helps underserved families and communities grow financially stronger – regardless of zip code.

Our Mission

Southern Bancorp’s mission is to create economic opportunity in underserved communities by providing responsible, responsive, and innovative financial products and services that balance profits with purpose.

Our Story

Thirty years ago, some of rural America’s most underserved and distressed communities gained an economic development partner when some of the nation’s leading business, political, and philanthropic leaders formed the Southern Development Bank Corporation, today known as Southern Bancorp.

With an initial investment of approximately $10 million, and a mission to create economic opportunity, Southern Bancorp, Inc., along with its development partners – Southern Bancorp Bank and Southern Bancorp Community Partners – has grown to become one of the largest community development organizations in the United States, as well as a model for an entire industry of mission-focused financial institutions known as Community Development Financial Institutions, or CDFIs. Today, Southern Bancorp is a $2.8 billion asset organization with over 65,000 customers and 56 branches located primarily in underserved markets in the Mid-South.

Southern Bancorp’s focus is on growing its impact and influence through responsive, responsible, and innovative product delivery to the un/underbanked, as well as developing strategic partnerships that help broaden its impact far beyond its physical market borders, such as with the CDFI Fund and the Global Alliance for Banking on Values (GABV).

Our Values

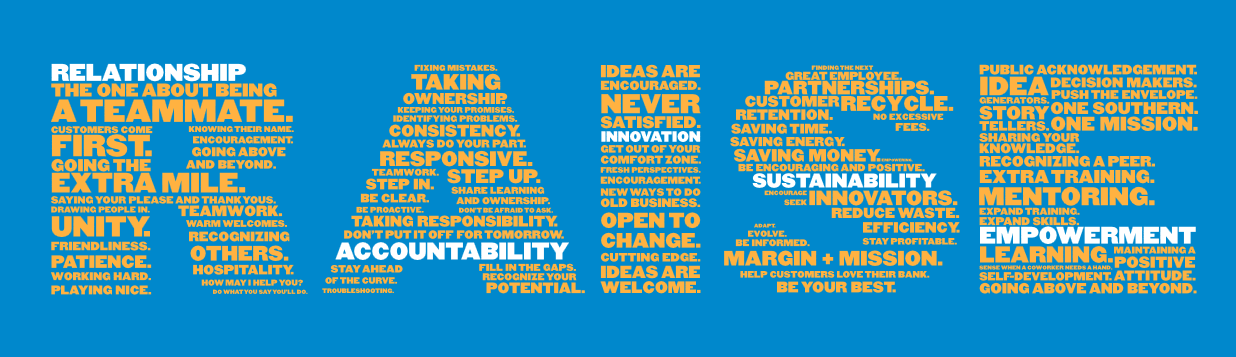

Southern Bancorp believes mission-driven banking is also values-based banking, which is why our core values are a critical component of the value we create for our stakeholders. Living our core values provides us with the foundation needed to pursue and achieve our vision, and our employees are rewarded for exhibiting these values. As an institution dedicated to raising communities up, it’s only fitting that Southern’s core values reflect that same spirit: R.A.I.S.E.

Our Markets

Our Impact

Southern Bancorp’s approach to creating economic opportunity in the most chronically impoverished areas is rooted in the belief that net worth drives economic opportunity for people and communities, and our strategic framework provides individuals an opportunity to build net worth through three primary routes: homeownership, entrepreneurship, and savings.