By James Owen

Southern’s mission is to be wealth builders for everyone.

If you’ve spent any time following our Twitter, Facebook, reading our blog posts, or participating in our community events, you’ve probably seen a post or had a conversation with a Southern employee about the unbanked and underbanked populations in Arkansas and Mississippi.

But what makes someone unbanked or underbanked? How do we define that? And why does Southern talk about it so much? We’ll be answering those questions – and more – over the course of the next few blog posts. But let’s start with what and where we’re talking about.

To be unbanked means that you have no formal connection to a bank. You don’t have a checking or savings account, you rely on alternative financial services like check cashers and payday lenders. [1] It’s likely that you live in a cash-only economy.

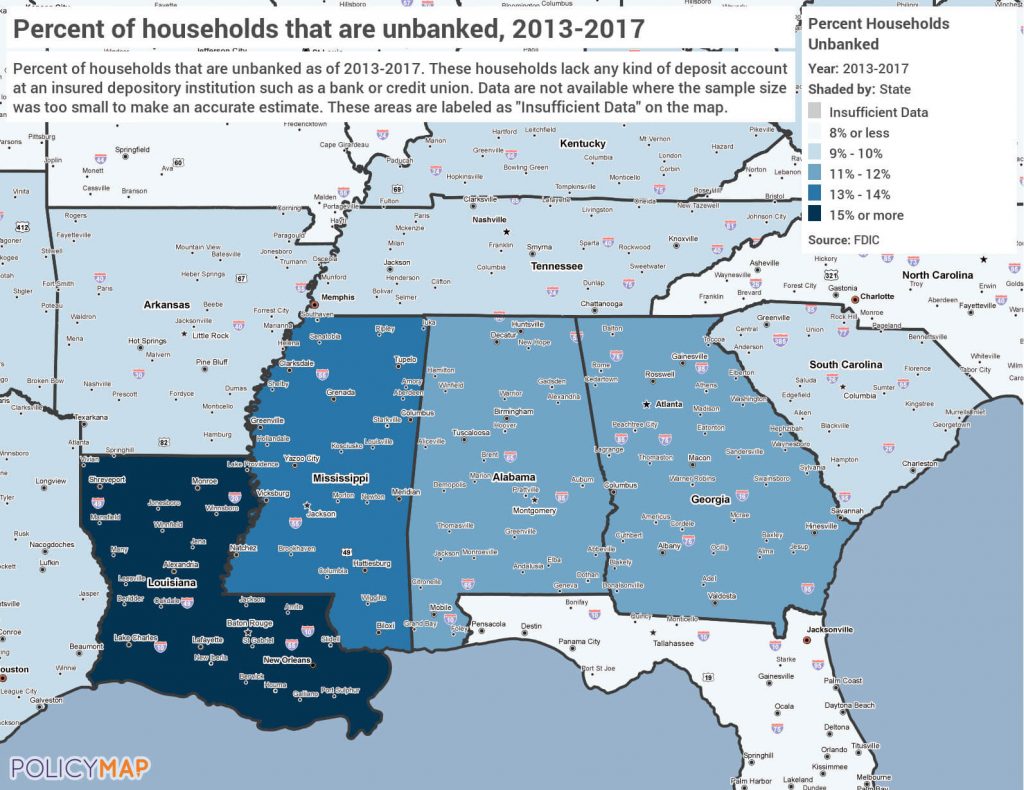

There are approximately 65,000 people in Arkansas that are unbanked – that’s about 8 percent of the state’s population, or about the size of Conway. In Mississippi, almost 95,000 people are unbanked, equivalent to 12 percent of Mississippians. Nationally, about 7 percent of households are unbanked. As the above map shows, there are a lot of unbanked households in the South.

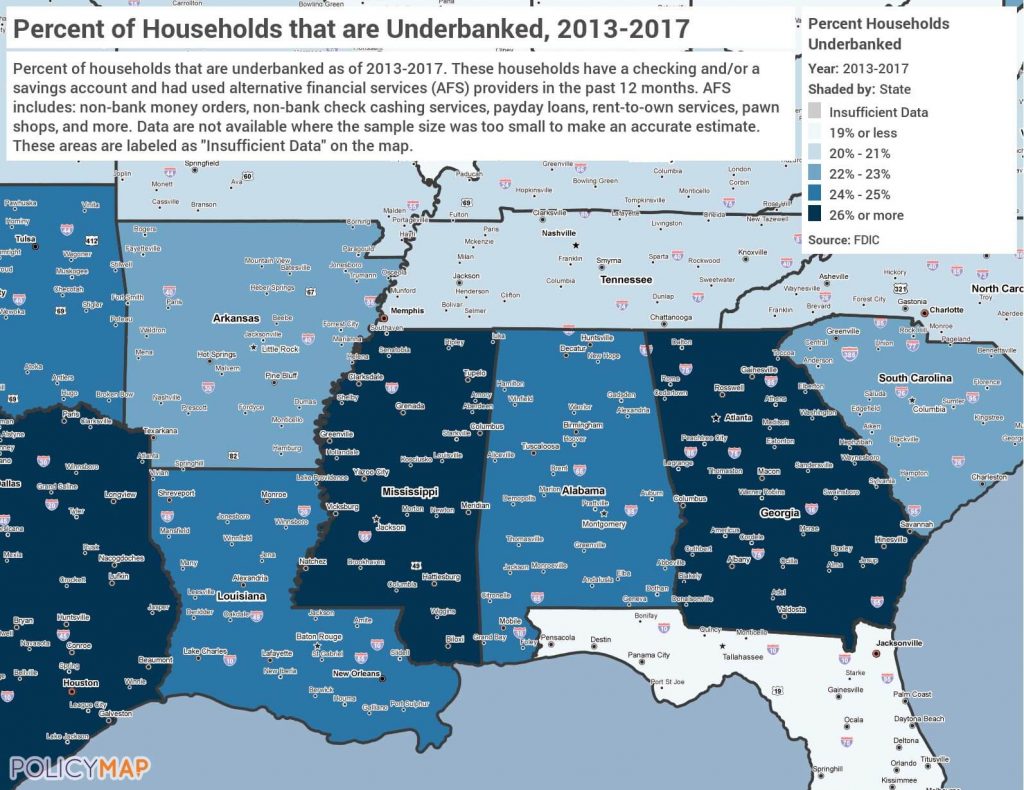

To be underbanked means that you have a banking relationship at an insured financial institution – like a checking account – but that you still use alternative financial services like money orders, check cashers, payday loans, refund anticipation loans, rent-to-own services, pawns shop loans, or auto title loans.[2] For instance, an underbanked household might have checking account, but they still use a check casher every payday.

Almost one-fourth of people in Arkansas are underbanked; more than one-fourth of Mississippians fall into this category. Combined, that’s almost 600,000 underbanked consumers in both states. Across the country, almost 20 percent of the population is underbanked.

Being unbanked and underbanked has real cost in people’s lives. It harms their financial health. It also can have negative economic implications for states with larger unbanked and underbanked populations. And it breaks down along racial lines. We’ll explore those topics in future posts, but, for now, the important takeaway is that there are too many people unable to build wealth because they are left out of the financial mainstream.

In order to be wealth builders for everyone, we have to

reach everyone. That’s why you hear us talk about the unbanked and underbanked

population so much.

[1] Apaam, G., Burhouse, S., Chu, K., Ernst, K., Fritzdixon, K., Goodstein, R., Lloro, A., Opoku, C., Osaki, Y., Sharma, D., & Weinstein, J. 2018. “2017 FDIC National Survey of Unbanked and Underbanked Households: Executive Summary.” https://www.fdic.gov/householdsurvey/2017/2017execsumm.pdf

[2] Apaam et al., 2018.